It’s on the Rise—And More To Know About ATO Fraud

By: Jim Stickley and Tina Davis

November 15, 2025

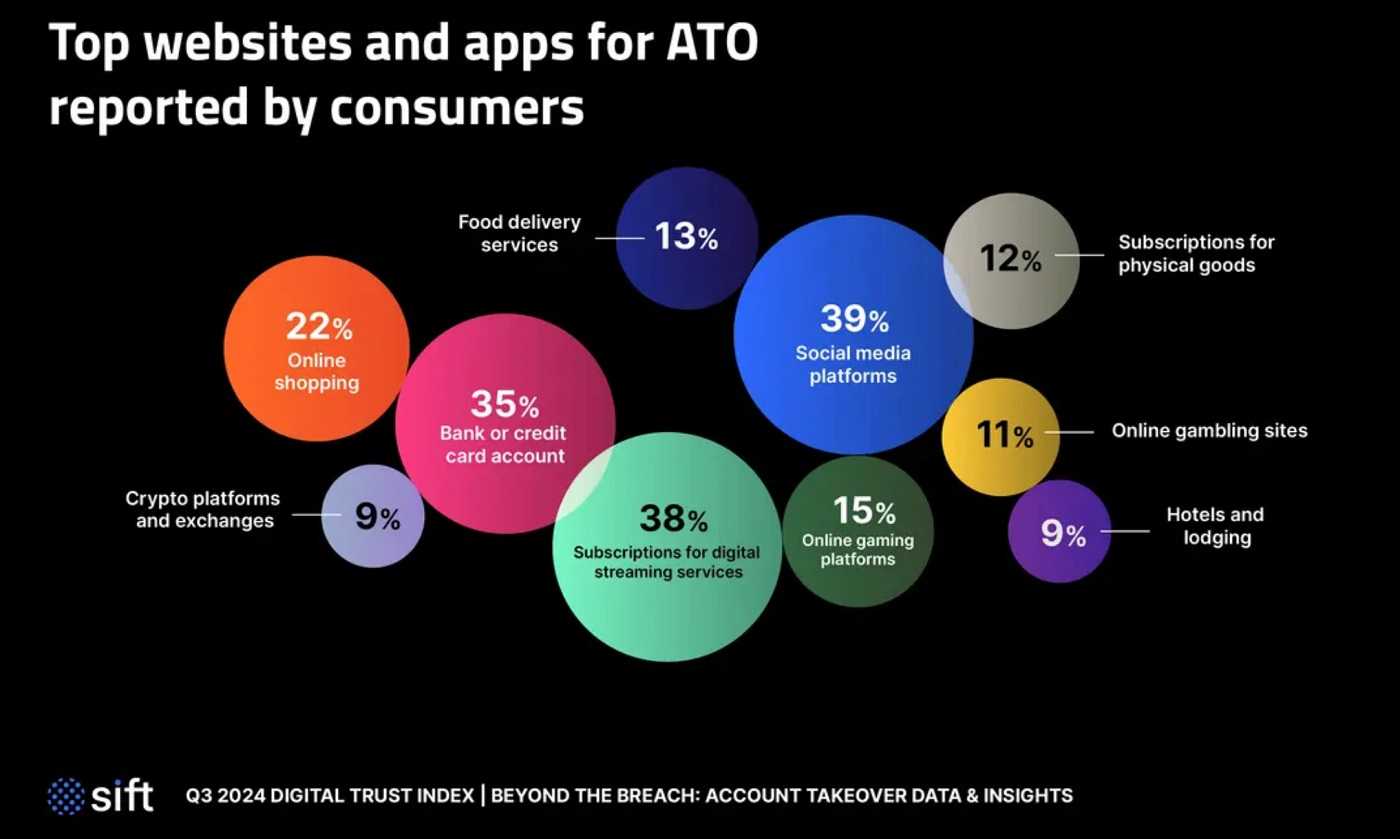

If you’re not able to login to an account, you might be victim to an account takeover (ATO). According to Spy Cloud, 22% of adults in the U.S. have experienced an ATO. And globally in 2023, ATOs grew by 155%. With this crime on the rise, it’s a smart idea to learn more about them.

ATO’s target individuals and organizations. But bringing ATOs home, Spy Cloud finds they affected more than 24 million households. Financial theft is the undisputed goal of an ATO. Attackers steal a victim’s identity to pilfer funds, open loans to buy cars and homes, and otherwise live large on a victim’s dime.

ATOs Made Easy Peasy

Compared to other types of cybercrime, ATOs are easier to pull-off since only a username and password are needed to steal an account. They’re often found for sale on the dark web, posted for free, or hijacked via phishing and malware.

With a basic ATO, the fraudster armed with login information, changes the password and username, locking the victim out of their account. Once done, the fraudster transfers funds out of the account into an intermediary account set up for the crime. Then, they siphon the funds into something that can’t be traced, and their account is closed.

ATO Cyber-Smarts

Make no mistake, an ATO is identity theft and financial fraud. The tips below help avoid this devastating crime.

- Always use two-factor authentication. It’s an added layer of identity assurance during account logins. This may be a one-time code sent to your phone or email. However, if you have other options, such as using an authenticator app, use those.

- Never respond to an unknown sender or caller, follow links, or open attachments, no matter what file type they may be.

- Call a message sender directly to verify if the message you received is legitimate. Don’t use information in the suspect message.

- Never respond to pressure tactics or alarming messages. You always have time to check into the concern.

- Never provide PII in an email, text or phone call, no matter who the requestor claims to be. Email and text are not generally considered secure forms of communication.

Being vigilant online is a requirement these days, and using common sense along with your Spidey-sense and cyber-smarts can help you save the day.