FBI Issues Alert About Rise in Financial Fraud

By: Jim Stickley and Tina Davis

August 30, 2025

You may not know that there’s a day dedicated to elder abuse awareness, but there is. Now, frankly, we think it’s wise to be aware of elder abuse every day, but the FBI recently called attention to World Elder Abuse Awareness Day by issuing an alert about an uptick in financial crimes against older people. Unfortunately, these scams not only harm people of all ages financially, but leave a lasting emotional damage.

To pull these off, criminals exploit various vulnerabilities such as loneliness, trust, and fear to take advantage of unsuspecting victims. Scammers may pretend to be romantic interests, friends or loved ones, technical support professionals, government agents, or financial advisors offering assistance. There is no end to who they may pretend to be.

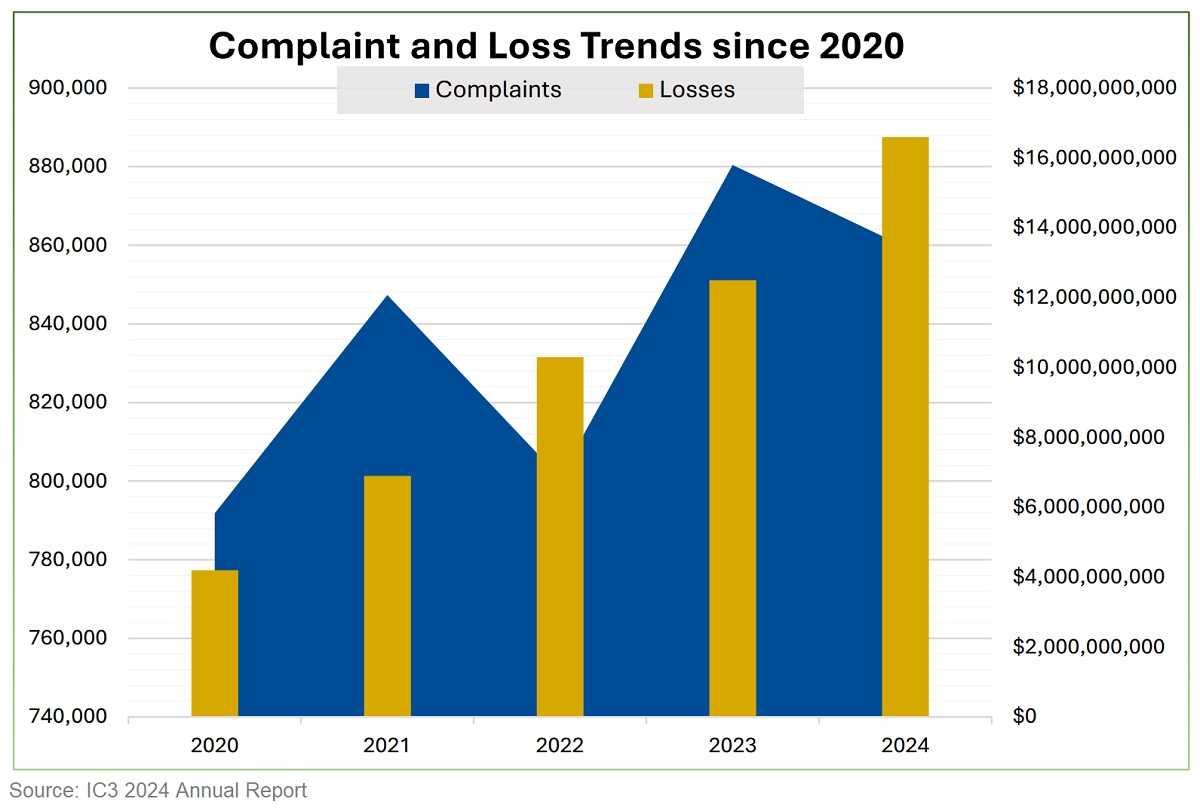

Last year, the FBI’s Internet Crime Complaint Center (IC3) reported $4.8 billion in losses to scams for Americans, which was a 43% increase over 2023.

It’s important to note that anyone can be a victim of financial fraud. According to the Better Business Bureau, 35-44 year olds are the most likely to run across scams and lose money as a result of them. However, 18-22 year olds had the highest median loss from them at $155 per incident.

To stay out of these statistics, you can remember a few tips:

- If you feel pressured to make a quick choice or do something with a threat of a bad penalty, stop. It’s likely a scam.

- If you’re asked to send money or pay with a gift card or cryptocurrency, or use an untraceable means of payment, it’s likely a scam.

- If they ask for personal information, make sure it’s a legitimate request before providing anything to them.

- Never send money to someone requesting it if you don’t actually know them, such as a romantic interest you’ve never met.

Again, anyone can be a victim of fraud. But it’s not a given. Keep your eyes open for the clues and you’ll be helping yourself a lot.